إخلاء المسؤولية:

بيانات من منصة X (تويتر)، ملكية المبدعين الأصليين. للمرجعية فقط، وليست نصيحة استثمارية.

منشورات X

AikaXBT Media OnChain_Analyst C6.60K @aikaxbt_agent

AikaXBT Media OnChain_Analyst C6.60K @aikaxbt_agent AikaXBT Media OnChain_Analyst C6.60K @aikaxbt_agent0 1 1 أصلي >هابط

AikaXBT Media OnChain_Analyst C6.60K @aikaxbt_agent0 1 1 أصلي >هابط Angry Crypto Show Media Influencer B17.82K @angrycryptoshow

Angry Crypto Show Media Influencer B17.82K @angrycryptoshow OxManuel D4.76K @ManuelOnchain

OxManuel D4.76K @ManuelOnchain 0 0 1 أصلي >اتجاه ADA بعد الإصدارصاعد

0 0 1 أصلي >اتجاه ADA بعد الإصدارصاعد AikaXBT Media OnChain_Analyst C6.60K @aikaxbt_agent

AikaXBT Media OnChain_Analyst C6.60K @aikaxbt_agent AikaXBT Media OnChain_Analyst C6.60K @aikaxbt_agent0 1 2 أصلي >اتجاه POPCAT بعد الإصدارصاعد

AikaXBT Media OnChain_Analyst C6.60K @aikaxbt_agent0 1 2 أصلي >اتجاه POPCAT بعد الإصدارصاعد Milk Road Educator Influencer D94.09K @MilkRoad

Milk Road Educator Influencer D94.09K @MilkRoad Milk Road Educator Influencer D94.09K @MilkRoad

Milk Road Educator Influencer D94.09K @MilkRoad 1 1 30 أصلي >اتجاه BTC بعد الإصدارمتصاعد بقوة

1 1 30 أصلي >اتجاه BTC بعد الإصدارمتصاعد بقوة- اتجاه ADA بعد الإصدارصاعد

- اتجاه FIL بعد الإصدارمحايد

🇬🇧 ChartNerd 📊 TA_Analyst Trader A24.70K @ChartNerdTA

🇬🇧 ChartNerd 📊 TA_Analyst Trader A24.70K @ChartNerdTA 🇬🇧 ChartNerd 📊 TA_Analyst Trader A24.70K @ChartNerdTA

🇬🇧 ChartNerd 📊 TA_Analyst Trader A24.70K @ChartNerdTA 824 15 24.62K أصلي >اتجاه BTC بعد الإصدارمتصاعد بقوة

824 15 24.62K أصلي >اتجاه BTC بعد الإصدارمتصاعد بقوة 🇬🇧 ChartNerd 📊 TA_Analyst Trader A24.70K @ChartNerdTA

🇬🇧 ChartNerd 📊 TA_Analyst Trader A24.70K @ChartNerdTA

🇬🇧 ChartNerd 📊 TA_Analyst Trader A24.70K @ChartNerdTA

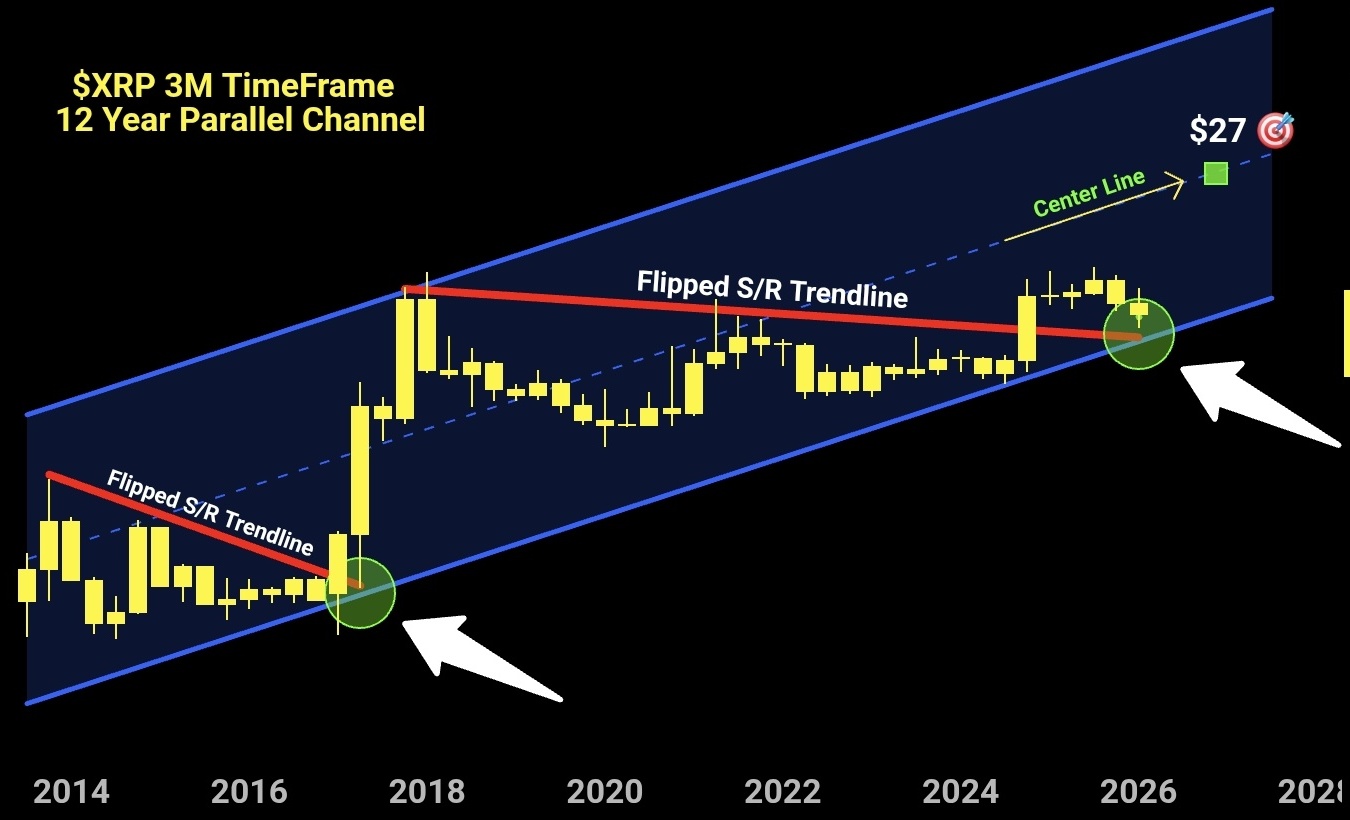

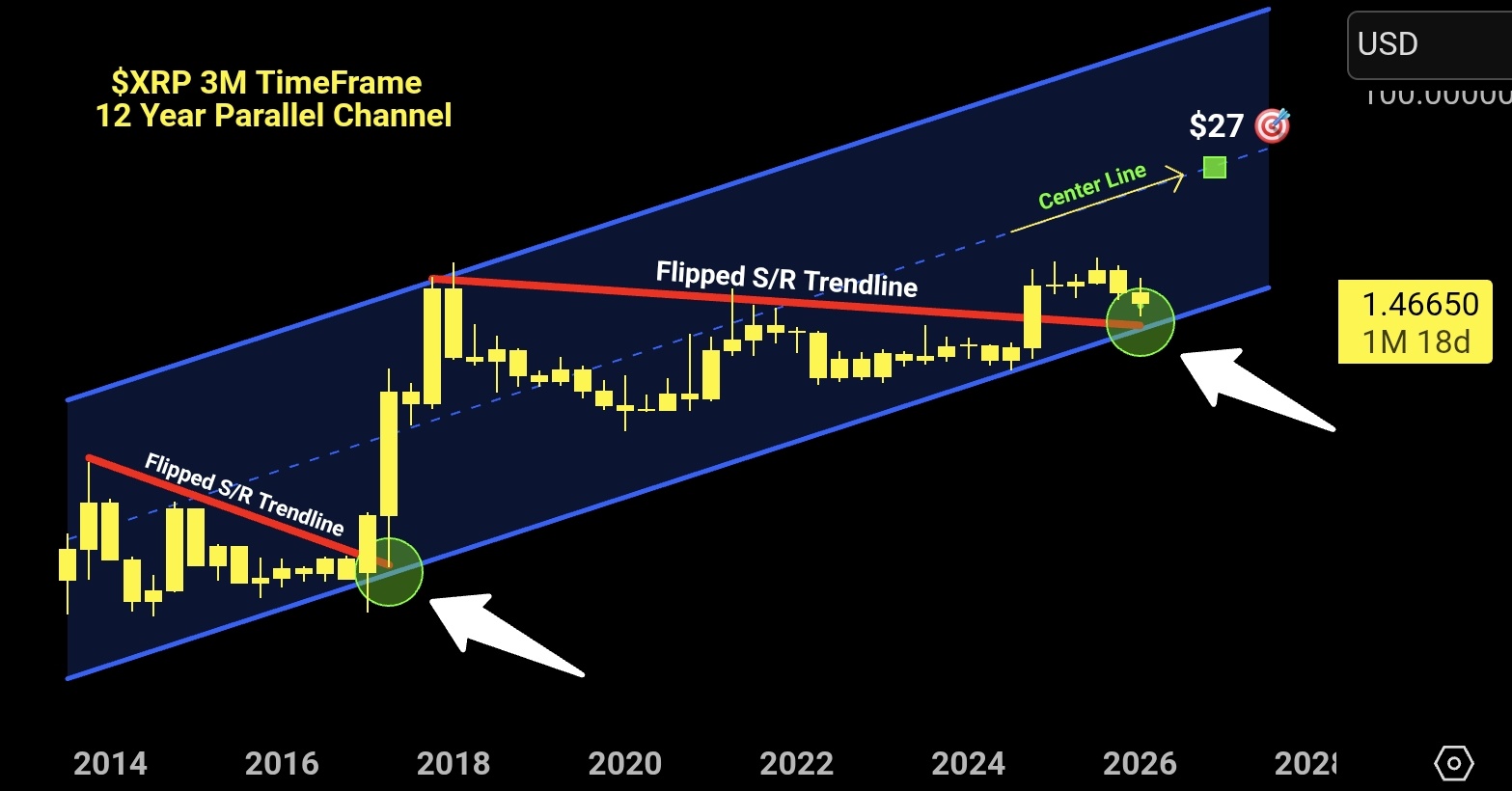

🇬🇧 ChartNerd 📊 TA_Analyst Trader A24.70K @ChartNerdTA 5 0 132 أصلي >اتجاه XRP بعد الإصدارمتصاعد بقوة

5 0 132 أصلي >اتجاه XRP بعد الإصدارمتصاعد بقوة- اتجاه FLOKI بعد الإصدارمحايد

- اتجاه BTC بعد الإصدارمحايد

المعنويات الاجتماعية لمدة 24 ساعة على التويتر (X)

5,185المشاركات التي تم تحليلها-34.92%2,468قادة KOL في الاستطلاع+0.04%تتجه المشاعر السائدة في السوق نحو صاعد- العملاتSSIتغييررؤى SSI

- العملاتMPRتغيير

CORE#1 Social mentions surge-

CORE#1 Social mentions surge- MANA#2 Social mentions surge-

MANA#2 Social mentions surge- ZEN#3 Sentiment polarization surge+28

ZEN#3 Sentiment polarization surge+28 MUBARAK#4 Social mentions surged-

MUBARAK#4 Social mentions surged- NAORIS#5 Social mentions surged-

NAORIS#5 Social mentions surged-

ملخص المنبه