SUI (SUI)

SUI (SUI)

$1.0214 +3.43% 24H

- 57مؤشر المعنويات الاجتماعية (SSI)-12.62% (24h)

- #100ترتيب اتجاه السوق (MPR)+8

- 19الانتشار الاجتماعي 24 سا-32.14% (24h)

- 69%نسبة KOL الصاعدة خلال 24 ساعة12 مؤثر KOL نشط

- ملخص

- إشارات صعود

- إشارات هبوط

مؤشر المعنويات الاجتماعية (SSI)

- البيانات الإجمالية57SSI

- اتجاه SSI (7ي)السعر (7 أيام)توزيع المشاعرمتصاعد بقوة (37%)صاعد (32%)محايد (26%)هابط بشدة (5%)رؤى SSI

ترتيب اتجاه السوق (MPR)

- منبه الرؤى

منشورات X

- اتجاه SUI بعد الإصدارمتصاعد بقوة

- اتجاه SUI بعد الإصدارمتصاعد بقوة

Stacy Muur FA_Analyst OnChain_Analyst B74.70K @stacy_muur

Stacy Muur FA_Analyst OnChain_Analyst B74.70K @stacy_muur

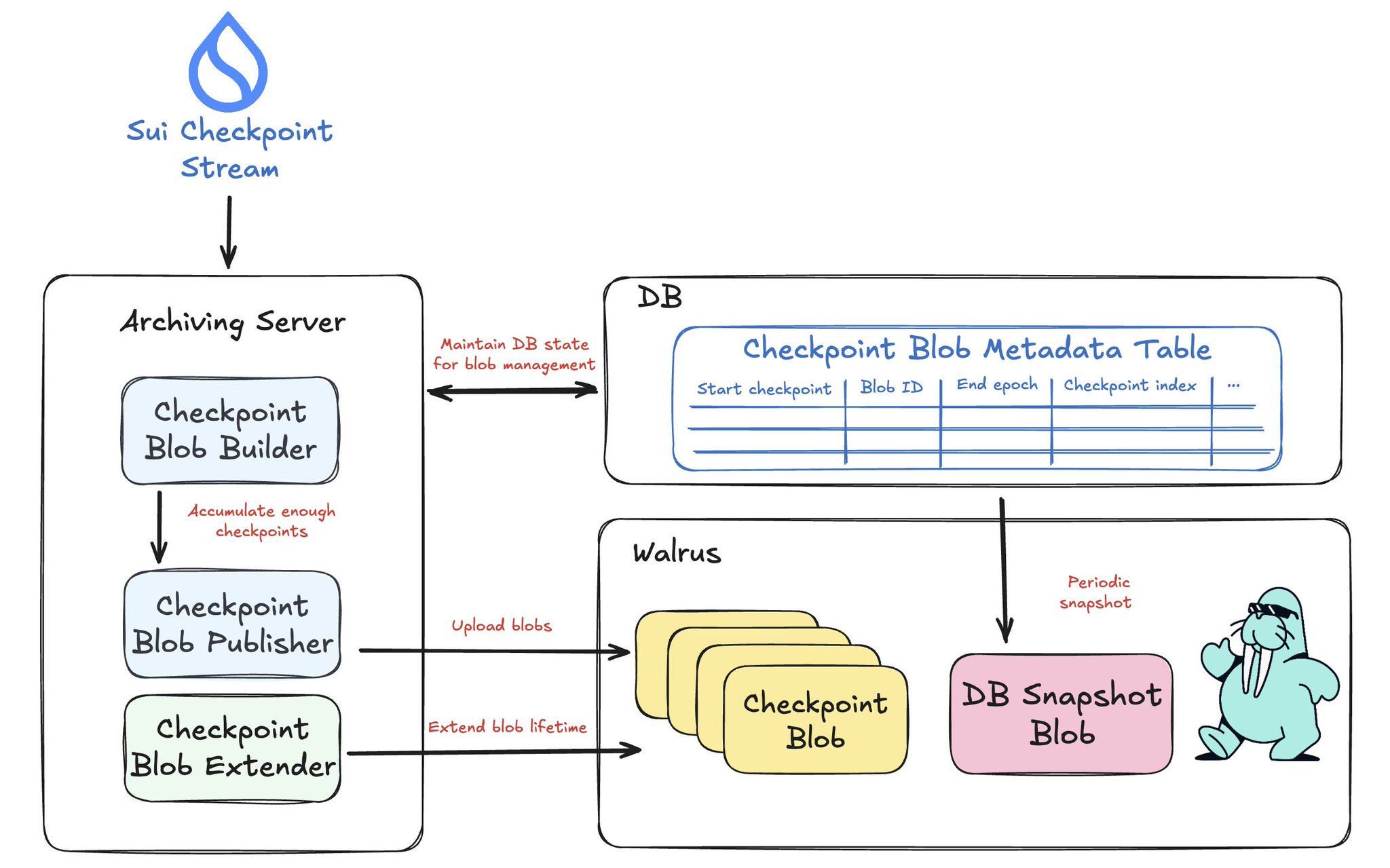

Walrus 🦭/acc D427.45K @WalrusProtocol

Walrus 🦭/acc D427.45K @WalrusProtocol 0 1 33 أصلي >اتجاه SUI بعد الإصدارمتصاعد بقوة

0 1 33 أصلي >اتجاه SUI بعد الإصدارمتصاعد بقوة- اتجاه SUI بعد الإصدارهابط

Ema26❤️ OnChain_Analyst DeFi_Expert B1.68K @jack33336666

Ema26❤️ OnChain_Analyst DeFi_Expert B1.68K @jack33336666

Ema26❤️ OnChain_Analyst DeFi_Expert B1.68K @jack333366664 1 23 أصلي >اتجاه SUI بعد الإصدارمتصاعد بقوة

Ema26❤️ OnChain_Analyst DeFi_Expert B1.68K @jack333366664 1 23 أصلي >اتجاه SUI بعد الإصدارمتصاعد بقوة Angelo.sui Community_Lead Influencer B18.83K @angelodotsui

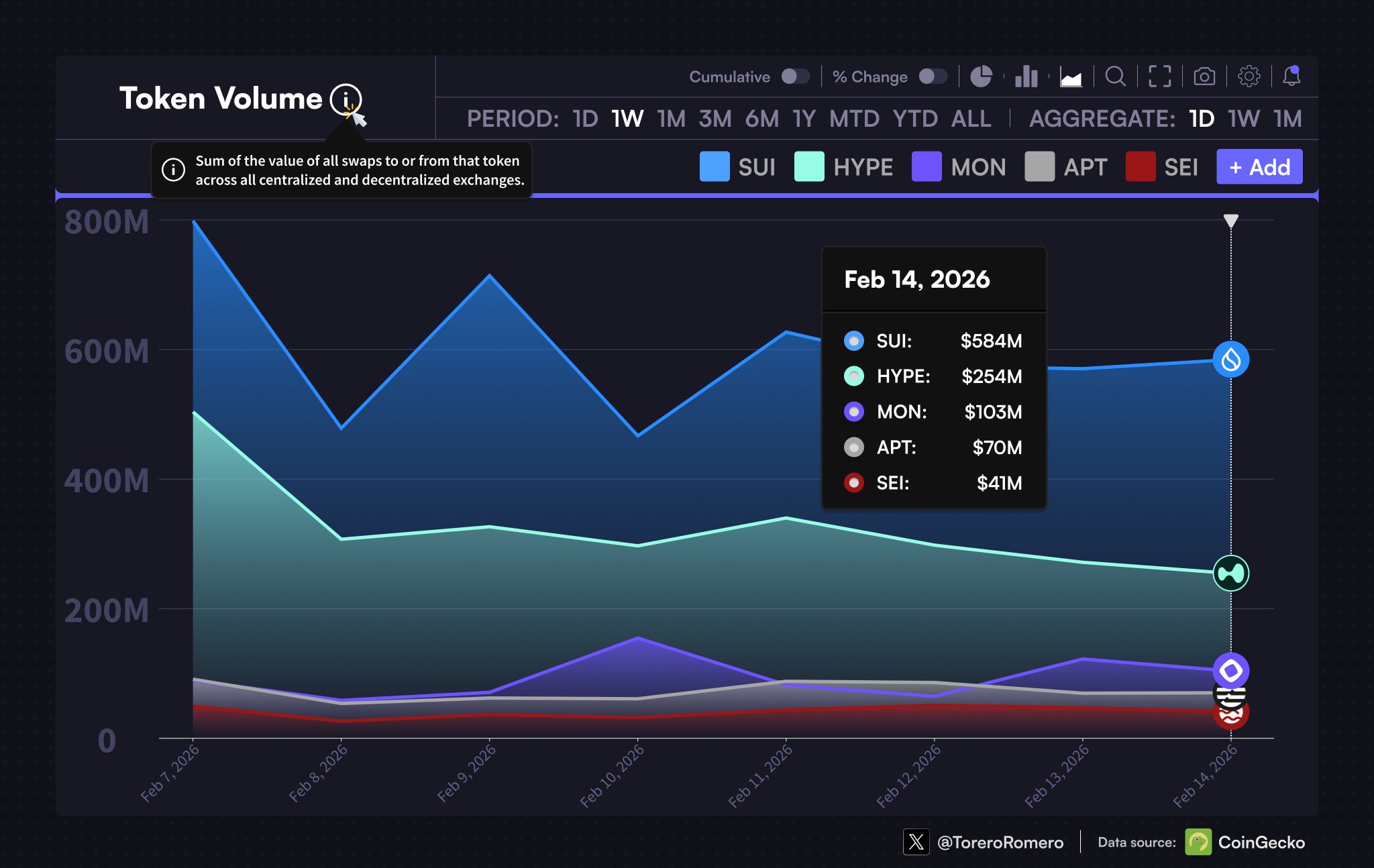

Angelo.sui Community_Lead Influencer B18.83K @angelodotsui ToreroRomero D8.86K @ToreroRomero

ToreroRomero D8.86K @ToreroRomero 15 0 655 أصلي >اتجاه SUI بعد الإصدارصاعد

15 0 655 أصلي >اتجاه SUI بعد الإصدارصاعد Raccoon Chan 小浣熊 Influencer Community_Lead B38.50K @RaccoonHKG

Raccoon Chan 小浣熊 Influencer Community_Lead B38.50K @RaccoonHKG

Raccoon Chan 小浣熊 Influencer Community_Lead B38.50K @RaccoonHKG10 1 3.08K أصلي >اتجاه SUI بعد الإصدارهابط بشدة

Raccoon Chan 小浣熊 Influencer Community_Lead B38.50K @RaccoonHKG10 1 3.08K أصلي >اتجاه SUI بعد الإصدارهابط بشدة Philose (delulu arc) Community_Lead Influencer B5.88K @Philose

Philose (delulu arc) Community_Lead Influencer B5.88K @Philose MrBreadSmith D16.61K @MrBreadSmith

MrBreadSmith D16.61K @MrBreadSmith 89 10 3.19K أصلي >اتجاه SUI بعد الإصدارصاعد

89 10 3.19K أصلي >اتجاه SUI بعد الإصدارصاعد tehMoonwalkeR FA_Analyst Influencer C133.91K @tehMoonwalkeR

tehMoonwalkeR FA_Analyst Influencer C133.91K @tehMoonwalkeR Kostas Kryptos Dev Researcher S27.07K @kostascrypto4 3 756 أصلي >اتجاه SUI بعد الإصدارصاعد

Kostas Kryptos Dev Researcher S27.07K @kostascrypto4 3 756 أصلي >اتجاه SUI بعد الإصدارصاعد Philose (delulu arc) Community_Lead Influencer B5.88K @Philose

Philose (delulu arc) Community_Lead Influencer B5.88K @Philose Tommy ✦ D2.18K @Tommy__one

Tommy ✦ D2.18K @Tommy__one 35 17 974 أصلي >اتجاه SUI بعد الإصدارصاعد

35 17 974 أصلي >اتجاه SUI بعد الإصدارصاعد