Pendle (PENDLE)

Pendle (PENDLE)

$1.2444 -0.96% 24H

- 52مؤشر المعنويات الاجتماعية (SSI)- (24h)

- #50ترتيب اتجاه السوق (MPR)0

- 3الانتشار الاجتماعي 24 سا- (24h)

- 100%نسبة KOL الصاعدة خلال 24 ساعة3 مؤثر KOL نشط

- ملخص

- إشارات صعود

- إشارات هبوط

مؤشر المعنويات الاجتماعية (SSI)

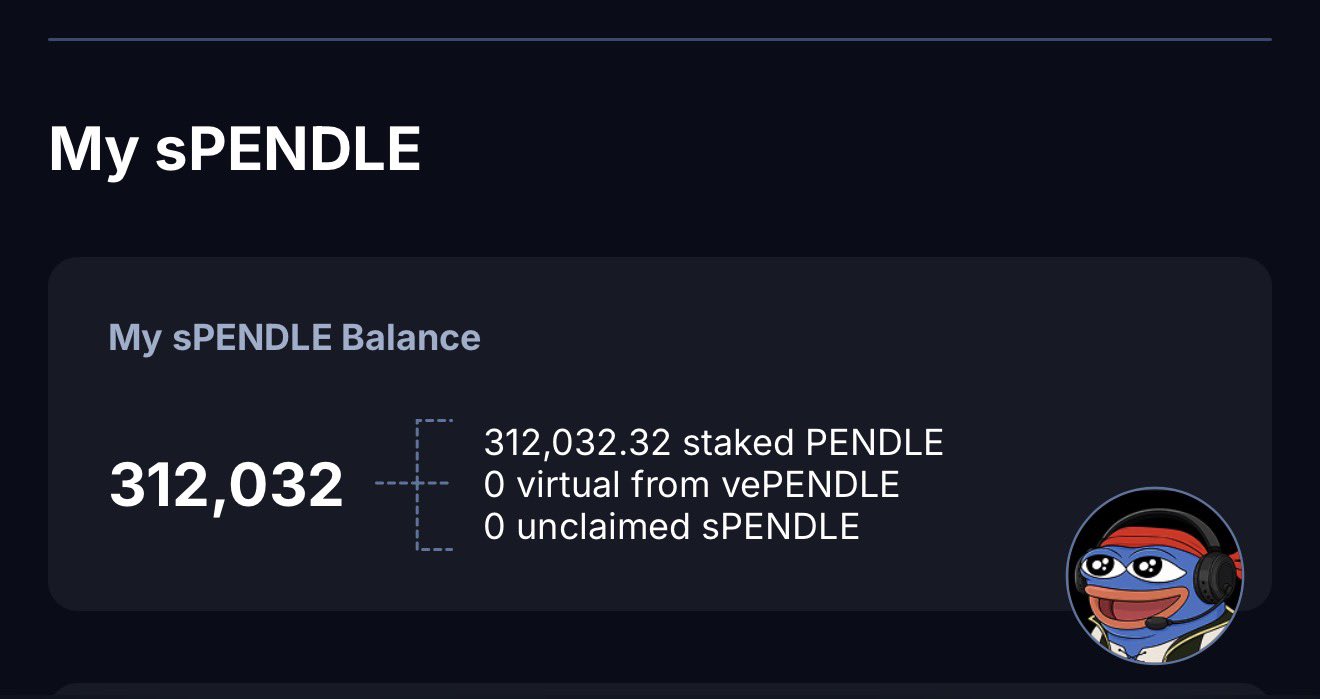

- البيانات الإجمالية52SSI

- اتجاه SSI (7ي)السعر (7 أيام)توزيع المشاعرمتصاعد بقوة (67%)صاعد (33%)رؤى SSI

ترتيب اتجاه السوق (MPR)

- منبه الرؤى

منشورات X

UNICORN⚡️🦄 Trader FA_Analyst C133.54K @UnicornBitcoin

UNICORN⚡️🦄 Trader FA_Analyst C133.54K @UnicornBitcoin

Pendle D160.07K @pendle_fi45 6 14.47K أصلي >اتجاه PENDLE بعد الإصدارمتصاعد بقوة

Pendle D160.07K @pendle_fi45 6 14.47K أصلي >اتجاه PENDLE بعد الإصدارمتصاعد بقوة- اتجاه PENDLE بعد الإصدارصاعد

- اتجاه PENDLE بعد الإصدارمتصاعد بقوة

- اتجاه PENDLE بعد الإصدارهابط بشدة

Neo Nguyen DeFi_Expert Tokenomics_Expert B3.03K @Neoo_Nav

Neo Nguyen DeFi_Expert Tokenomics_Expert B3.03K @Neoo_Nav Pendle D160.07K @pendle_fi

Pendle D160.07K @pendle_fi 108 14 7.20K أصلي >اتجاه PENDLE بعد الإصدارصاعد

108 14 7.20K أصلي >اتجاه PENDLE بعد الإصدارصاعد 𝕯𝖆𝖓𝖌𝖊𝖗 Trader OnChain_Analyst C51.68K @safetyth1rd

𝕯𝖆𝖓𝖌𝖊𝖗 Trader OnChain_Analyst C51.68K @safetyth1rd Today in DeFi D17.22K @todayindefi

Today in DeFi D17.22K @todayindefi 4 0 606 أصلي >اتجاه PENDLE بعد الإصدارمحايد

4 0 606 أصلي >اتجاه PENDLE بعد الإصدارمحايد Conny FA_Analyst OnChain_Analyst B10.97K @ConnyConny253

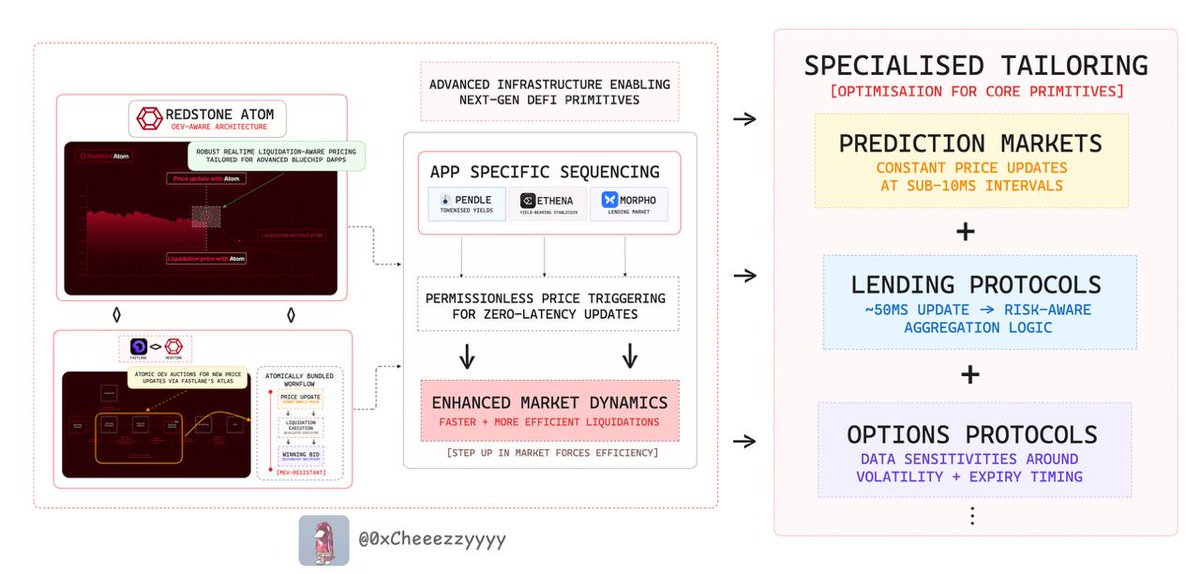

Conny FA_Analyst OnChain_Analyst B10.97K @ConnyConny253 Cheeezzyyyy D9.34K @0xCheeezzyyyy

Cheeezzyyyy D9.34K @0xCheeezzyyyy

90 54 3.43K أصلي >اتجاه PENDLE بعد الإصدارمتصاعد بقوة

90 54 3.43K أصلي >اتجاه PENDLE بعد الإصدارمتصاعد بقوة Dami-Defi TA_Analyst Trader B91.39K @DamiDefi

Dami-Defi TA_Analyst Trader B91.39K @DamiDefi Dami-Defi TA_Analyst Trader B91.39K @DamiDefi224 44 24.16K أصلي >اتجاه PENDLE بعد الإصدارمحايد

Dami-Defi TA_Analyst Trader B91.39K @DamiDefi224 44 24.16K أصلي >اتجاه PENDLE بعد الإصدارمحايد Data Wolf 🐺 OnChain_Analyst DeFi_Expert C2.52K @0xDataWolf

Data Wolf 🐺 OnChain_Analyst DeFi_Expert C2.52K @0xDataWolf

RightSide D6.96K @Rightsideonly1 0 99 أصلي >اتجاه PENDLE بعد الإصدارهابط بشدة

RightSide D6.96K @Rightsideonly1 0 99 أصلي >اتجاه PENDLE بعد الإصدارهابط بشدة- اتجاه PENDLE بعد الإصدارمحايد