LAB (LAB)

LAB (LAB)

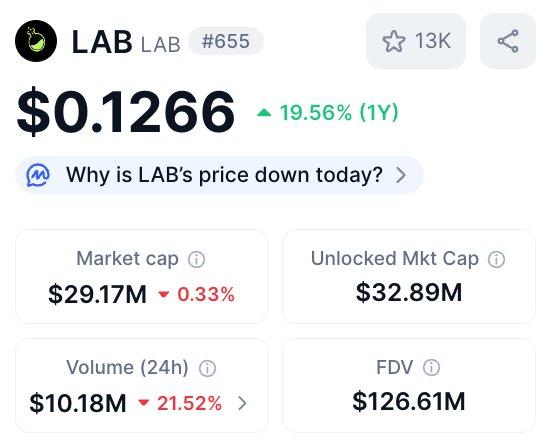

$0.11357 -0.07% 24H

- 62مؤشر المعنويات الاجتماعية (SSI)- (24h)

- #75ترتيب اتجاه السوق (MPR)0

- 3الانتشار الاجتماعي 24 سا- (24h)

- 67%نسبة KOL الصاعدة خلال 24 ساعة3 مؤثر KOL نشط

- ملخص

- إشارات صعود

- إشارات هبوط

مؤشر المعنويات الاجتماعية (SSI)

- البيانات الإجمالية62SSI

- اتجاه SSI (7ي)السعر (7 أيام)توزيع المشاعرصاعد (67%)هابط (33%)رؤى SSI

ترتيب اتجاه السوق (MPR)

- منبه الرؤى

منشورات X

Carlitosway 🔺 Influencer Community_Lead A30.56K @Carlitoswa_y

Carlitosway 🔺 Influencer Community_Lead A30.56K @Carlitoswa_y Cookie DAO 🍪 Community_Lead Tokenomics_Expert B199.38K @cookiedotfun192 123 7.21K أصلي >اتجاه LAB بعد الإصدارهابط

Cookie DAO 🍪 Community_Lead Tokenomics_Expert B199.38K @cookiedotfun192 123 7.21K أصلي >اتجاه LAB بعد الإصدارهابط- اتجاه LAB بعد الإصدارصاعد

- اتجاه LAB بعد الإصدارصاعد

- اتجاه LAB بعد الإصدارصاعد

- اتجاه LAB بعد الإصدارصاعد

- اتجاه LAB بعد الإصدارمتصاعد بقوة

- اتجاه LAB بعد الإصدارصاعد

- اتجاه LAB بعد الإصدارصاعد

BLADE DeFi_Expert Influencer C76.30K @BladeDefi

BLADE DeFi_Expert Influencer C76.30K @BladeDefi symbiote D109.40K @cryptosymbiiote

symbiote D109.40K @cryptosymbiiote 14 3 4.36K أصلي >اتجاه LAB بعد الإصدارصاعد

14 3 4.36K أصلي >اتجاه LAB بعد الإصدارصاعد- اتجاه LAB بعد الإصدارصاعد