STBL (STBL)

STBL (STBL)

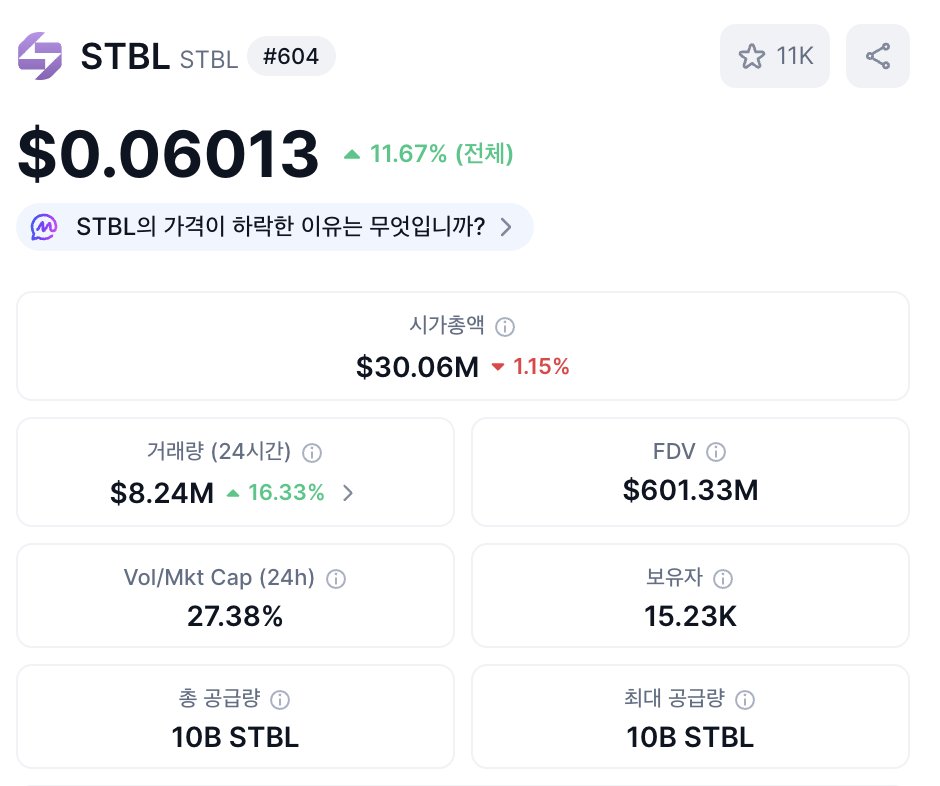

$0.06324 +14.67% 24H

- 51Social Sentiment Index (SSI)-12.81% (24h)

- #111Market Pulse Ranking (MPR)+25

- 1124h Social Mention+10.00% (24h)

- 63%24h KOL Bullish Ratio6 Active KOL

- Summary

- Bullish Signals

- Bearish Signals

Social Sentiment Index (SSI)

- Data Overall51SSI

- SSI Trend (7D)Price (7D)Sentiment DistributionExtremely Bullish (36%)Bullish (27%)Neutral (18%)Bearish (19%)SSI Insights

Market Pulse Ranking (MPR)

- Alert Insight

X Posts

- Trend of STBL after releaseExtremely Bullish

- Trend of STBL after releaseExtremely Bullish

- Trend of STBL after releaseBearish

코루🍊 .edge🦭 FA_Analyst DeFi_Expert B35.13K @colu_farmerToffees ∞ KIN (❖,❖) D2.78K @q2q2cc31 18 1.59K Original >Trend of STBL after releaseExtremely Bullish

코루🍊 .edge🦭 FA_Analyst DeFi_Expert B35.13K @colu_farmerToffees ∞ KIN (❖,❖) D2.78K @q2q2cc31 18 1.59K Original >Trend of STBL after releaseExtremely Bullish- Trend of STBL after releaseBullish

Searchfi/MemeMax⚡️ Community_Lead Influencer C169.21K @searchfi_eth

Searchfi/MemeMax⚡️ Community_Lead Influencer C169.21K @searchfi_eth 산할 .edge🦭/ 🌊RIVER D3.66K @AGeullo

산할 .edge🦭/ 🌊RIVER D3.66K @AGeullo 93 93 933 Original >Trend of STBL after releaseExtremely Bullish

93 93 933 Original >Trend of STBL after releaseExtremely Bullish- Trend of STBL after releaseBullish

- Trend of STBL after releaseNeutral

코루🍊 .edge🦭 FA_Analyst DeFi_Expert B35.13K @colu_farmer

코루🍊 .edge🦭 FA_Analyst DeFi_Expert B35.13K @colu_farmer

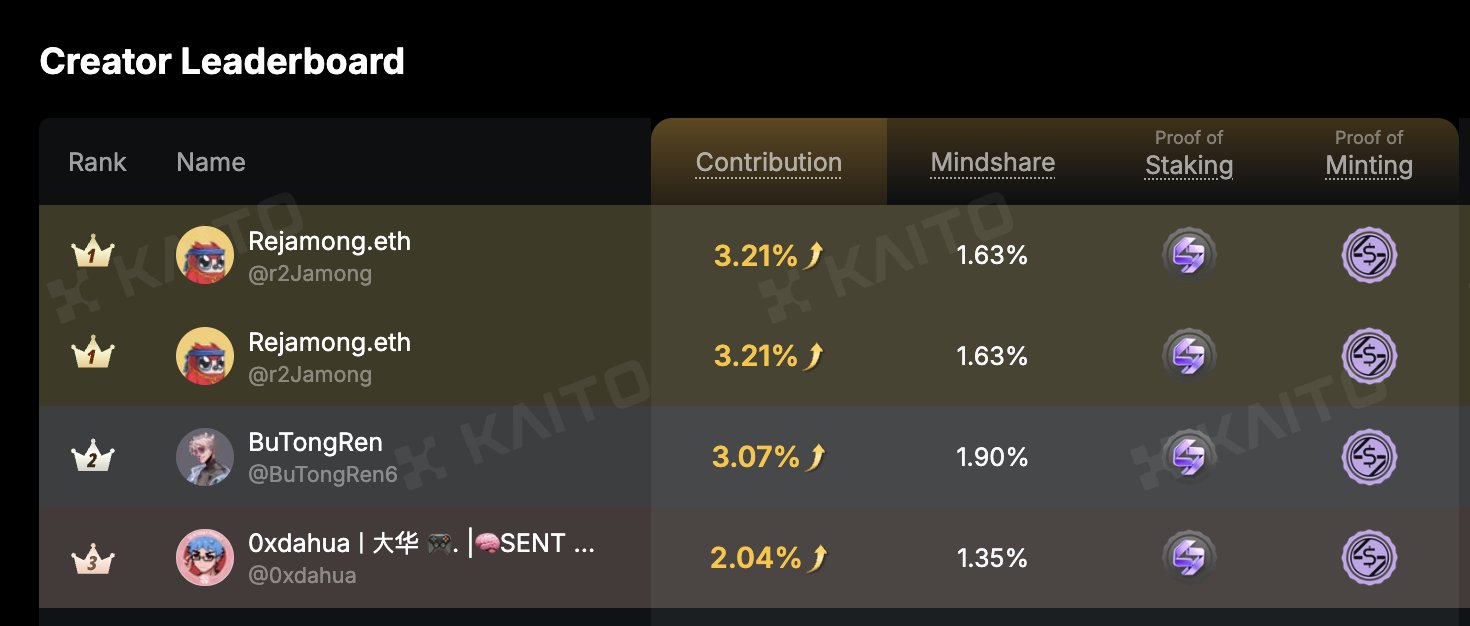

Rejamong.eth D13.75K @r2Jamong

Rejamong.eth D13.75K @r2Jamong 35 28 1.85K Original >Trend of STBL after releaseBearish

35 28 1.85K Original >Trend of STBL after releaseBearish- Trend of STBL after releaseNeutral