Rayls (RLS)

Rayls (RLS)

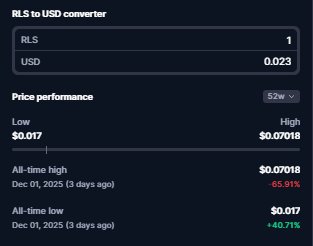

$0.02342 +17.93% 24H

- 56Social Sentiment Index (SSI)+77.00% (24h)

- #131Market Pulse Ranking (MPR)+7

- 324h Social Mention+200.00% (24h)

- 66%24h KOL Bullish Ratio3 Active KOL

- Summary

- Bullish Signals

- Bearish Signals

Social Sentiment Index (SSI)

- Data Overall56SSI

- SSI Trend (7D)Price (7D)Sentiment DistributionExtremely Bullish (33%)Bullish (33%)Bearish (34%)SSI Insights

Market Pulse Ranking (MPR)

- Alert Insight

X Posts

- Trend of RLS after releaseBearish

- Trend of RLS after releaseExtremely Bullish

brey Founder Researcher B45.14K @0xBreyn

brey Founder Researcher B45.14K @0xBreyn brey Founder Researcher B45.14K @0xBreyn177 131 9.89K Original >Trend of RLS after releaseBullish

brey Founder Researcher B45.14K @0xBreyn177 131 9.89K Original >Trend of RLS after releaseBullish Cookie DAO 🍪 Community_Lead Tokenomics_Expert B199.38K @cookiedotfun

Cookie DAO 🍪 Community_Lead Tokenomics_Expert B199.38K @cookiedotfun

Cookie DAO 🍪 Community_Lead Tokenomics_Expert B199.38K @cookiedotfun

Cookie DAO 🍪 Community_Lead Tokenomics_Expert B199.38K @cookiedotfun 246 93 18.87K Original >Trend of RLS after releaseBullish

246 93 18.87K Original >Trend of RLS after releaseBullish Zamza Salim Influencer Educator B54.23K @Autosultan_team

Zamza Salim Influencer Educator B54.23K @Autosultan_team

Zamza Salim Influencer Educator B54.23K @Autosultan_team

Zamza Salim Influencer Educator B54.23K @Autosultan_team 133 104 7.18K Original >Trend of RLS after releaseExtremely Bearish

133 104 7.18K Original >Trend of RLS after releaseExtremely Bearish- Trend of RLS after releaseExtremely Bullish

nbaluong 🟨 Influencer Community_Lead A7.77K @luong4101992

nbaluong 🟨 Influencer Community_Lead A7.77K @luong4101992 nbaluong 🟨 Influencer Community_Lead A7.77K @luong4101992

nbaluong 🟨 Influencer Community_Lead A7.77K @luong4101992 103 124 985 Original >Trend of RLS after releaseExtremely Bullish

103 124 985 Original >Trend of RLS after releaseExtremely Bullish- Trend of RLS after releaseExtremely Bullish

- Trend of RLS after releaseBullish

Airdrop Official 🦇🔊 Influencer Media C210.47K @its_airdrop

Airdrop Official 🦇🔊 Influencer Media C210.47K @its_airdrop

Zun D39.26K @Zun2025

Zun D39.26K @Zun2025

137 28 21.19K Original >Trend of RLS after releaseBearish

137 28 21.19K Original >Trend of RLS after releaseBearish