How @chainlink Solves Stablecoin Issues: a rebuttal to the IMF

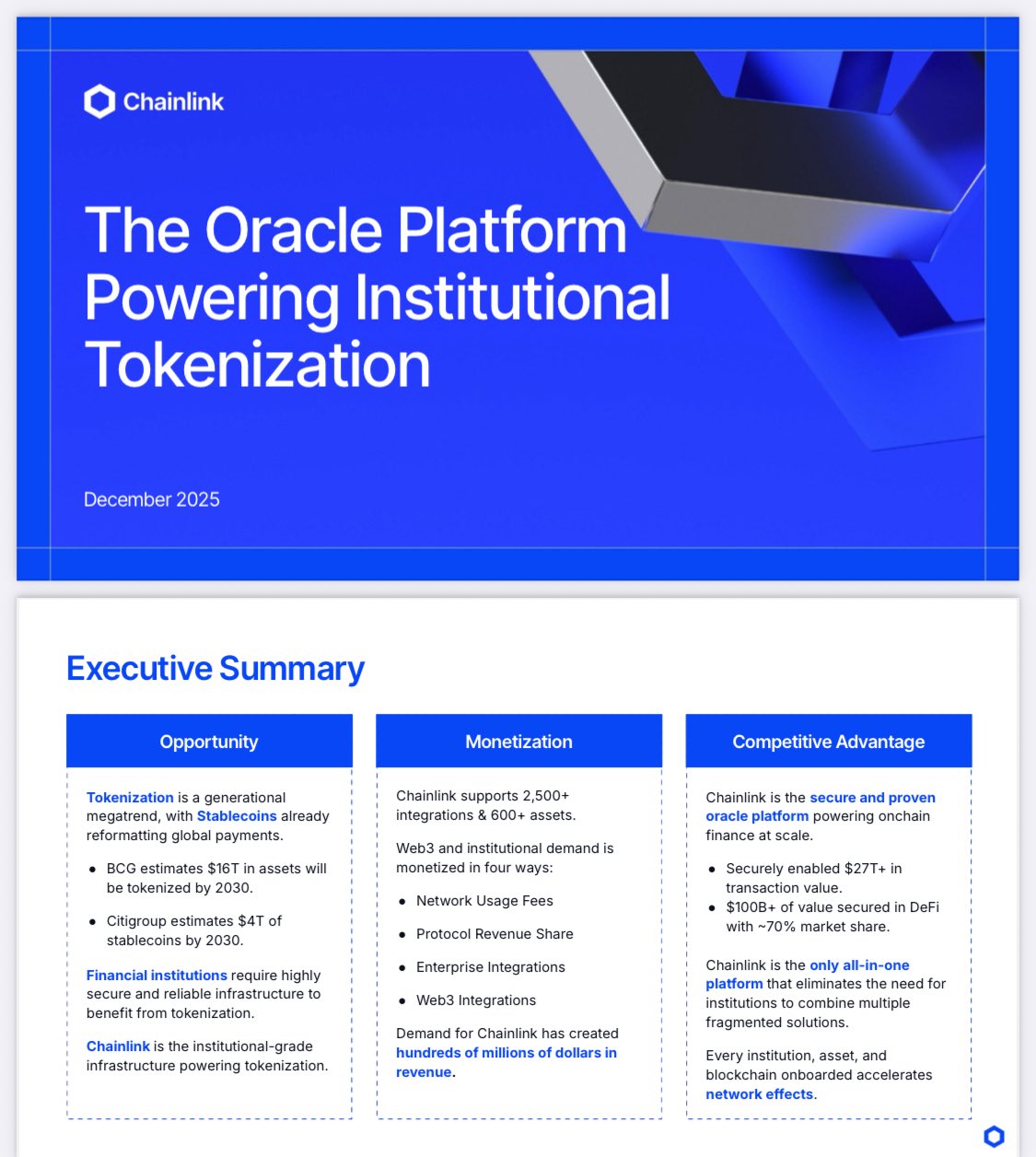

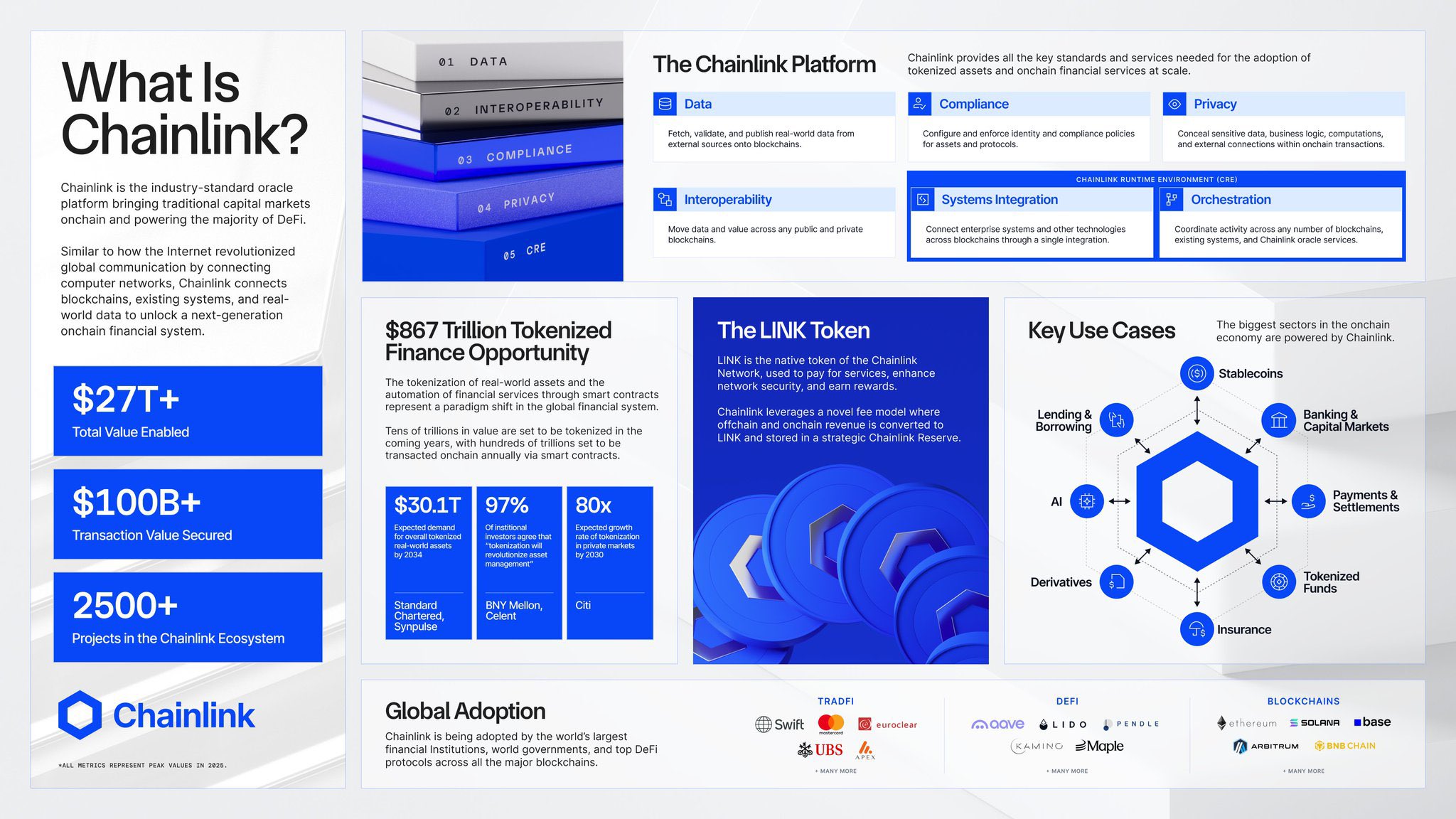

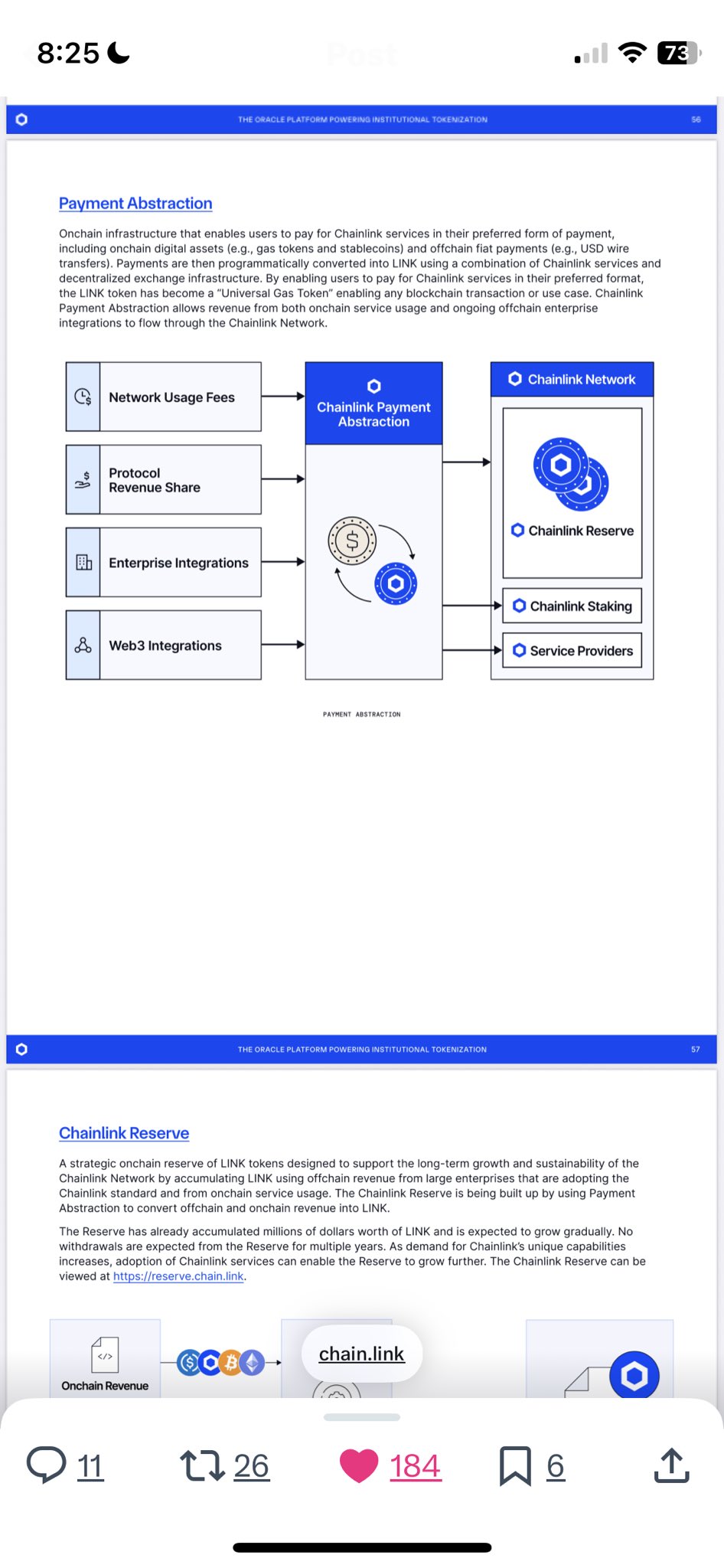

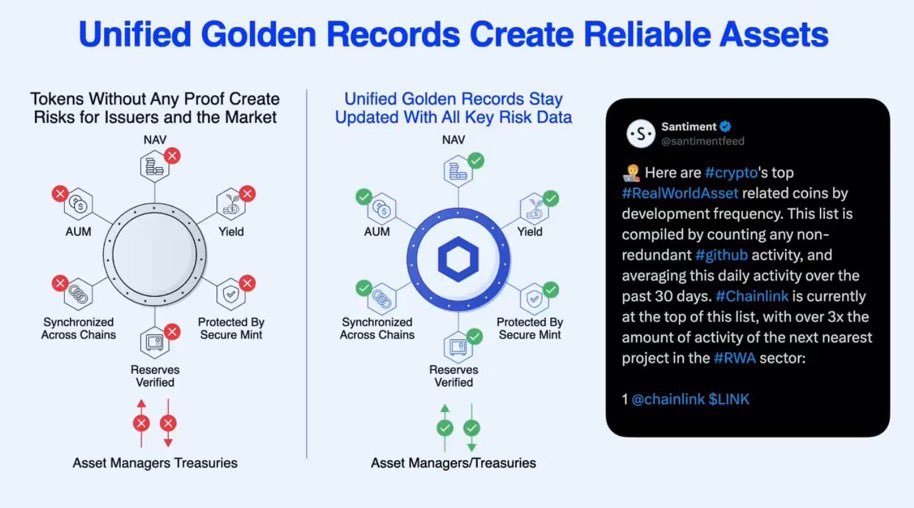

Chainlink addresses the core challenges highlighted in the IMF's "Understanding Stablecoins" report, such as reserve transparency risks, liquidity fragmentation across chains, regulatory arbitrage due to jurisdictional differences, and tail risks like fire sales or runs, by providing a unified, programmable infrastructure layer.

Chainlink powers the security, interoperability, and compliance necessary for scaling Stablecoins through tools like Proof of Reserve (PoR)/ Secure Mint, Cross-Chain Interoperability Protocol (CCIP), and the Chainlink Runtime Environment (CRE). These enable real-time verification of reserves to authorize or halt issuance, seamless cross-chain movement, and automated policy enforcement, turning stablecoins into "programmable money" that adapt to market conditions and regulations without introducing new vulnerabilities.

🪙 Transparency and Reserve Risks (Infinite Mint Attacks, Peg Deviation):

Chainlink PoR delivers continuous, on-chain proof of a stablecoin's backing assets (like T-Bills), allowing smart contracts to verify 1:1 collateralization in real time. This prevents over-issuance by integrating "Secure Mint" checks, where new tokens can only be minted if reserves are sufficient. For instance, it can segment reserves by jurisdiction to comply with local rules, greatly reducing risk by providing verifiable data for automated circuit breakers, arbitrage signals and whatever else is needed for compliance.

**This directly mitigates the IMF-noted lack of liquidity backstops, as PoR data can trigger central bank-like interventions via smart contracts.**

🔀Liquidity Fragmentation and Cross-Border Flows:

CCIP enables stablecoins to move natively across blockchains (BASE to Solana to Canton) without bridges, slippage, or liquidity silos, unifying cross-border activity. Programmable Token Transfers allow bundled instructions, like conditional payments or FX settlements, ensuring no fragmentation, such as in EMDE capital flight scenarios. Thusly reducing arbitrage-driven compression on T-Bill yields.

⚖️ Regulatory Fragmentation and Compliance:

Chainlink's Automated Compliance Engine (ACE) and on-chain identity tools (CCID) enforce jurisdiction-specific rules dynamically, all via smart contracts that auto-adjust for fees, collateral, or KYC, accordingly.

Partnerships like S&P Global integrate real-time Stablecoin Stability Assessments (SSAs) for risk metrics (asset quality, redeemability), while collaborations with Apex Group and Bermuda's regulator embed supervision for EMDE flows.

CRE unifies these into one workflow, minimizing offshore seigniorage extraction by enabling "compliance-by-design" that bridges fragmented rules without manual overhead.

✋Tail Risks and Systemic Plumbing:

By feeding tamper-proof data such as price feeds for peg monitoring and enabling automation (dynamic rebalancing), Chainlink reduces run risks in T-Bill markets. DeFi Yield Indices provide yield insights without violating interest bans, prioritizing 24/7 institutional and government plumbing over retail utility.

In essence, Chainlink has built a single, secure gateway for stablecoin issuers, while scaling tokenized assets and global finance. $LINK the 🌎

Chainlink (LINK)

Chainlink (LINK) wahndo FA_Analyst Media A6.39K @Wahndo_

wahndo FA_Analyst Media A6.39K @Wahndo_ wahndo FA_Analyst Media A6.39K @Wahndo_

wahndo FA_Analyst Media A6.39K @Wahndo_ 260 5 5.69K Original >Trend of LINK after releaseBullish

260 5 5.69K Original >Trend of LINK after releaseBullish AncientMedicine OnChain_Analyst Tokenomics_Expert B2.55K @AncientMedicin3

AncientMedicine OnChain_Analyst Tokenomics_Expert B2.55K @AncientMedicin3

AncientMedicine OnChain_Analyst Tokenomics_Expert B2.55K @AncientMedicin33 2 142 Original >Trend of LINK after releaseExtremely Bullish

AncientMedicine OnChain_Analyst Tokenomics_Expert B2.55K @AncientMedicin33 2 142 Original >Trend of LINK after releaseExtremely Bullish Bubbafox FA_Analyst Influencer B25.52K @bob4punk

Bubbafox FA_Analyst Influencer B25.52K @bob4punk Chainlink Dev Researcher C1.38M @chainlink

Chainlink Dev Researcher C1.38M @chainlink 793 35 37.27K Original >Trend of LINK after releaseBullish

793 35 37.27K Original >Trend of LINK after releaseBullish Robin τ Tokenomics_Expert Educator B9.95K @Robin_T100

Robin τ Tokenomics_Expert Educator B9.95K @Robin_T100 General TAO Ventures D1.80K @gtaoventures3 0 162 Original >Trend of LINK after releaseBullish

General TAO Ventures D1.80K @gtaoventures3 0 162 Original >Trend of LINK after releaseBullish AncientMedicine OnChain_Analyst Tokenomics_Expert B2.55K @AncientMedicin3

AncientMedicine OnChain_Analyst Tokenomics_Expert B2.55K @AncientMedicin3 AncientMedicine OnChain_Analyst Tokenomics_Expert B2.55K @AncientMedicin316 3 466 Original >Trend of LINK after releaseBullish

AncientMedicine OnChain_Analyst Tokenomics_Expert B2.55K @AncientMedicin316 3 466 Original >Trend of LINK after releaseBullish