Polkadot (DOT)

Polkadot (DOT)

$2.134 +0.28% 24H

- 51Social Sentiment Index (SSI)+5.51% (24h)

- #111Market Pulse Ranking (MPR)+41

- 1424h Social Mention+27.27% (24h)

- 86%24h KOL Bullish Ratio4 Active KOL

- Summary

- Bullish Signals

- Bearish Signals

Social Sentiment Index (SSI)

- Data Overall51SSI

- SSI Trend (7D)Price (7D)Sentiment DistributionBullish (86%)Neutral (7%)Bearish (7%)SSI Insights

Market Pulse Ranking (MPR)

- Alert Insight

X Posts

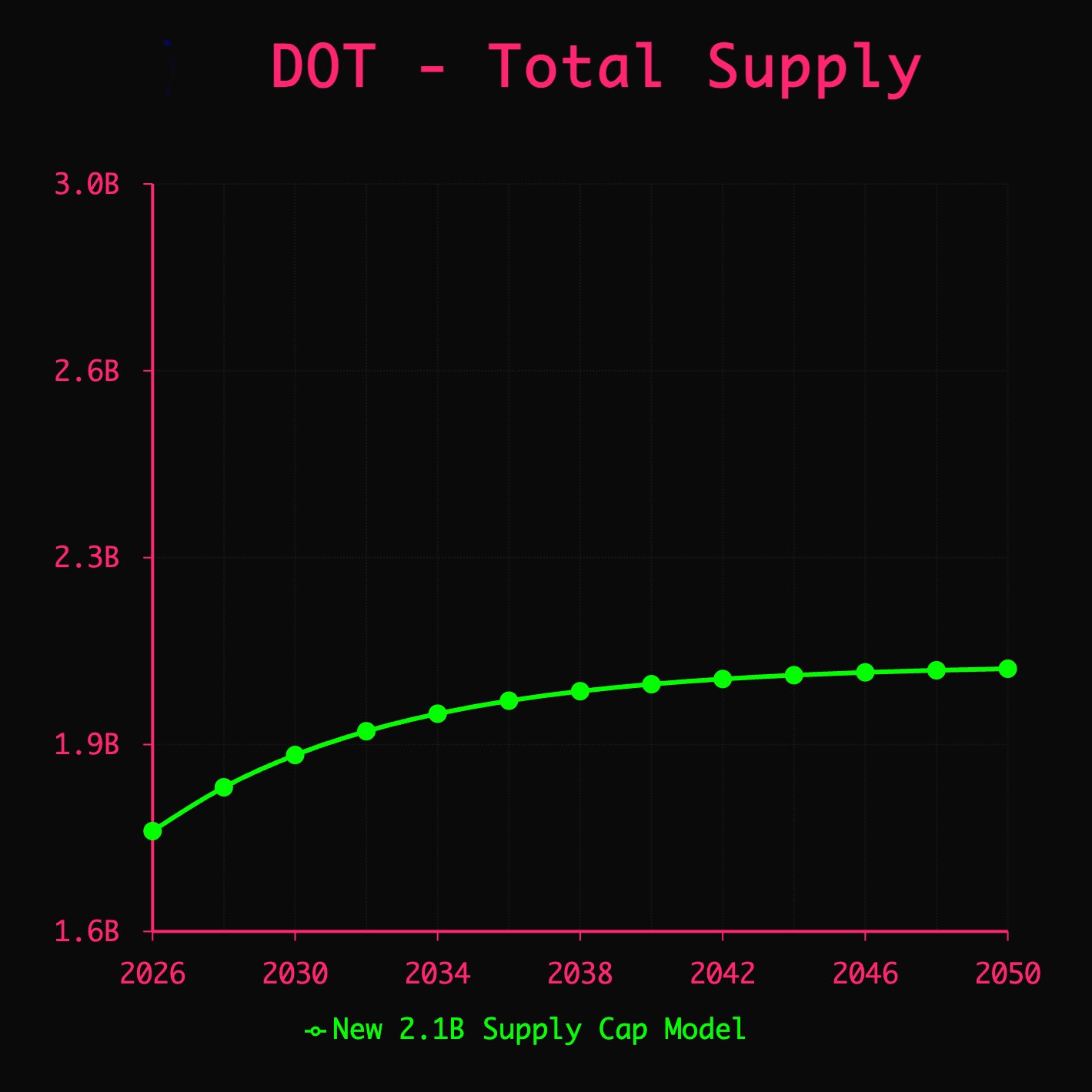

PolkaWorld Media Community_Lead B15.95K @polkaworld_org

PolkaWorld Media Community_Lead B15.95K @polkaworld_org PolkaWorld Media Community_Lead B15.95K @polkaworld_org62 2 3.78K Original >Trend of DOT after releaseBullish

PolkaWorld Media Community_Lead B15.95K @polkaworld_org62 2 3.78K Original >Trend of DOT after releaseBullish PolkaWorld Media Community_Lead B15.95K @polkaworld_org

PolkaWorld Media Community_Lead B15.95K @polkaworld_org PolkaWorld Media Community_Lead B15.95K @polkaworld_org52 3 2.12K Original >Trend of DOT after releaseBullish

PolkaWorld Media Community_Lead B15.95K @polkaworld_org52 3 2.12K Original >Trend of DOT after releaseBullish PolkaWorld Media Community_Lead B15.95K @polkaworld_org

PolkaWorld Media Community_Lead B15.95K @polkaworld_org PolkaWorld Media Community_Lead B15.95K @polkaworld_org37 0 1.70K Original >Trend of DOT after releaseBullish

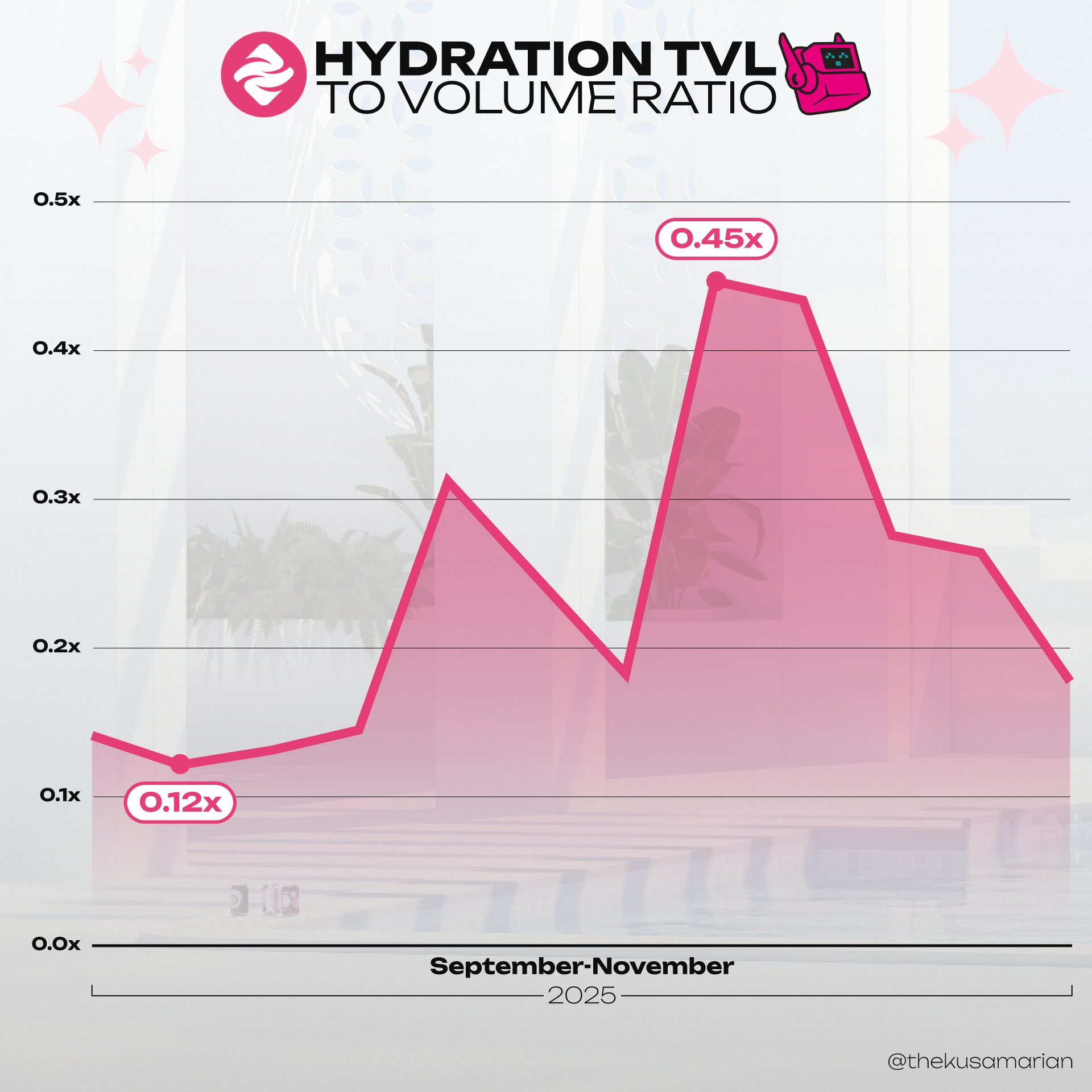

PolkaWorld Media Community_Lead B15.95K @polkaworld_org37 0 1.70K Original >Trend of DOT after releaseBullish The Kus Media Researcher B32.17K @TheKusamarian

The Kus Media Researcher B32.17K @TheKusamarian The Kus Media Researcher B32.17K @TheKusamarian18 3 632 Original >Trend of DOT after releaseNeutral

The Kus Media Researcher B32.17K @TheKusamarian18 3 632 Original >Trend of DOT after releaseNeutral The Kus Media Researcher B32.17K @TheKusamarian

The Kus Media Researcher B32.17K @TheKusamarian The Kus Media Researcher B32.17K @TheKusamarian

The Kus Media Researcher B32.17K @TheKusamarian 23 3 1.04K Original >Trend of DOT after releaseBullish

23 3 1.04K Original >Trend of DOT after releaseBullish CryptoGuerrilla ⚔️ FA_Analyst TA_Analyst B8.06K @Crypto_Guerrila

CryptoGuerrilla ⚔️ FA_Analyst TA_Analyst B8.06K @Crypto_Guerrila Polkadot D1.60M @Polkadot

Polkadot D1.60M @Polkadot 1 0 364 Original >Trend of DOT after releaseBullish

1 0 364 Original >Trend of DOT after releaseBullish- Trend of DOT after releaseBullish

PolkaWorld Media Community_Lead B15.95K @polkaworld_org

PolkaWorld Media Community_Lead B15.95K @polkaworld_org PolkaWorld Media Community_Lead B15.95K @polkaworld_org62 2 3.78K Original >Trend of DOT after releaseBullish

PolkaWorld Media Community_Lead B15.95K @polkaworld_org62 2 3.78K Original >Trend of DOT after releaseBullish- Trend of DOT after releaseBullish

The Kus Media Researcher B32.17K @TheKusamarian

The Kus Media Researcher B32.17K @TheKusamarian The Kus Media Researcher B32.17K @TheKusamarian40 3 1.37K Original >Trend of DOT after releaseBullish

The Kus Media Researcher B32.17K @TheKusamarian40 3 1.37K Original >Trend of DOT after releaseBullish